Building Financial Literacy Through Real Experience

Since 2019, we've helped over 850 professionals master financial statement analysis with practical, hands-on learning that actually works in the real world.

Our Journey Started With a Problem

Back in early 2019, Marcus Chen was consulting for mid-size companies in Seoul when he noticed something troubling. Finance teams were struggling with basic ratio analysis. Not because they lacked intelligence, but because traditional training focused on theory instead of real-world application.

That insight led to our first workshop with 12 participants. We ditched PowerPoint presentations and used actual company statements from recent bankruptcies and success stories. The difference was immediate and measurable.

The People Behind the Programs

Our team combines decades of hands-on financial analysis experience with proven educational methods that actually stick.

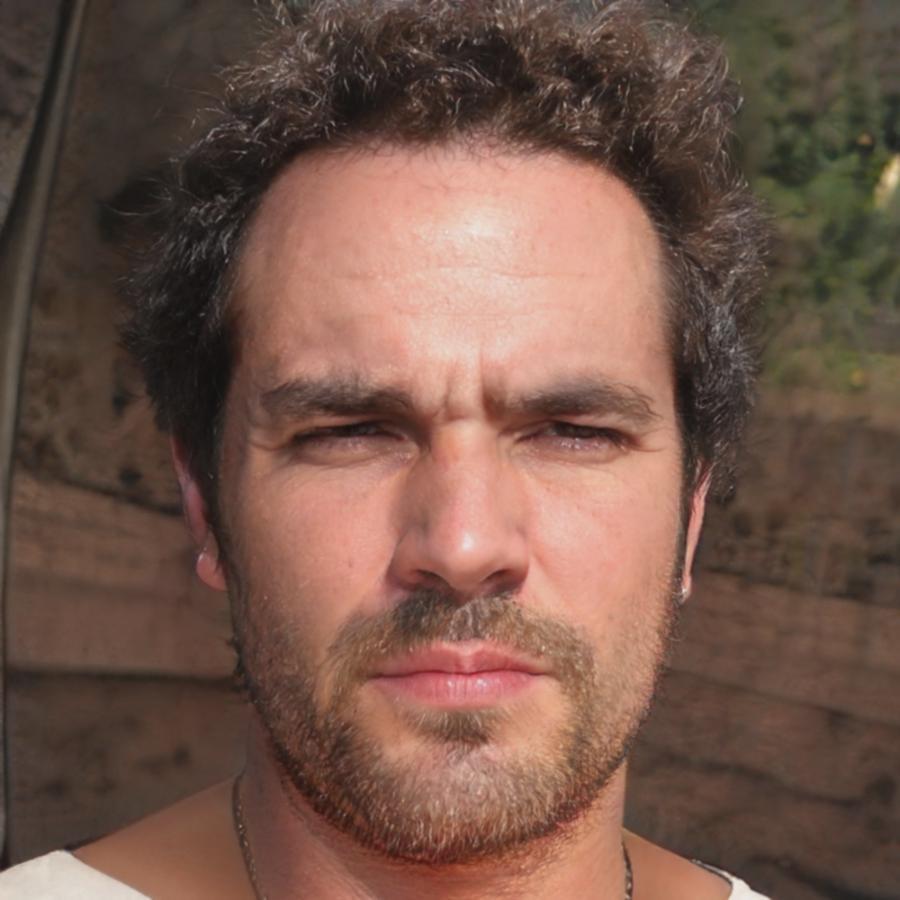

Marcus Chen

Lead Financial Analyst & Program Director

Fifteen years analyzing financial statements for everything from tech startups to manufacturing giants. Marcus developed our case study methodology after seeing too many analysts struggle with textbook approaches that don't work in practice. His specialty is spotting red flags in seemingly healthy balance sheets.

David Park

Senior Education Specialist

Former banking analyst who spent eight years in credit risk assessment before joining our education team. David designs our practical exercises using real company data from the past decade. He has a talent for breaking down complex ratios into understandable patterns that students actually remember.

CFA Institute

Chartered Financial Analyst certification with focus on equity analysis

Risk Management

Financial Risk Manager certification from GARP

Education Excellence

Adult Learning Specialist certification for professional training

How We Actually Teach Financial Analysis

Forget memorizing formulas. Our method focuses on pattern recognition and real-world application using actual company statements from recent market events.

Real Case Analysis

Start with actual financial statements from companies that faced major challenges or achieved remarkable success. No hypothetical scenarios - only real data from the past three years.

Pattern Recognition

Learn to spot warning signs and positive indicators by comparing similar companies across different time periods. Build intuition through repetition with varied examples.

Practical Application

Practice analysis on companies from your industry or areas of interest. Apply techniques to current market situations and recent financial news.

Peer Discussion

Compare findings with other participants and learn from different perspectives. Discover blind spots and strengthen analytical confidence through group analysis.

Case Study Focus

Every lesson centers around actual company statements. Recent examples include the 2024 analysis of major retail bankruptcies and surprising tech company recoveries.

Industry Relevance

Choose cases relevant to your field. Whether manufacturing, tech, or services, practice with companies similar to those you analyze daily.

What Drives Our Work

We believe financial analysis should be practical, honest, and focused on real results rather than academic theory.

Practical Over Theoretical

Every technique we teach has been tested in real business situations. We don't waste time on academic exercises that look good on paper but fail in practice.

Honest Assessment Standards

We set realistic expectations about what financial analysis can and cannot reveal. Some trends are clear, others require additional context, and we teach you to recognize the difference.

Excellence in Financial Education

Recognized by the Korean Institute of Finance for innovative teaching methods in 2024

Corporate Training Partnership

Trusted by 78 companies for developing their finance teams' analytical capabilities